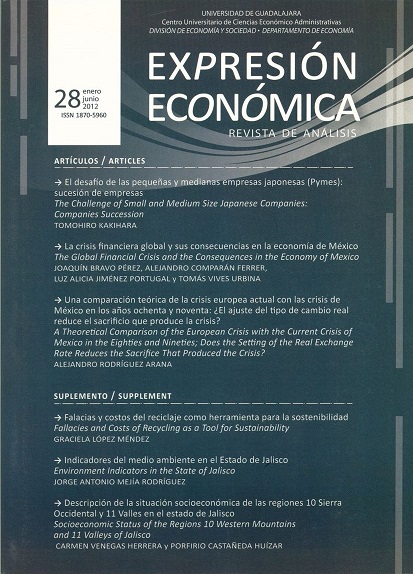

A theoretical comparison of the european crisis with the current crisis of Mexico in the eighties and nineties: Does the setting of the real exchange rate reduces the sacrifice that produced the crisis?

DOI:

https://doi.org/10.32870/eera.vi28.605Keywords:

Crisis, Current account, debtAbstract

This paper compares at a theoretical level the effects of a crisis like the one faced by different European countries nowadays and the Mexican crisis of the eighties and ni-neties. The initial conditions of the crisis are similar in both cases. The most important difference is that the adjustment in the real exchange rate in Europe is almost null in the short run because the affected countries are in the Euro zone. In both cases there must be a sacrifice in terms of production. If the initial debt is denominated in foreign currency, it not clear whether the sacrifice maintaining the real exchange rate constant is greater than in the case where this variable adjusts.

Downloads

Published

Issue

Section

License

Copyright (c) 2016 University of Guadalajara

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.